Contents:

4) No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account. 1) KYC is one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (Broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary. For instance, you might find a company to be overvalued if you just take a look at its PB ratio and may skip investing in it due to this. However, compared to the industry average and its peers, the company may have a better PB ratio, making it a more attractive investment option even though it is overvalued.

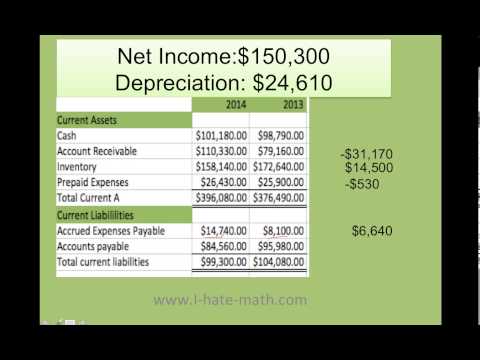

The estimate is often accurate because it is generally derived from previous business data. As a result, market investors and analysts can determine a company’s value fairly and accurately. You may look for the numbers required to determine the book value of a firm or asset in its income statement. A balance sheet has columns for liabilities and assets, along with the percentage by which each has depreciated.

Such references do not imply that it is intended to announce such products, programs or facilities in your country. You may consult your local advisors for information regarding the products, programs and services that may be available to you. Determining the book value of a company is a fairly straightforward approach. One simply has to look at the corresponding figures in the Balance Sheet and apply the aforementioned formula.

Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Book value is the worth of a company based on its financial books. Market value is the worth of a company based on the perceived worth by the market. Companies or industries that extensively rely on their human capital will have an inappropriate reflection of their worth in their financial statements. Therefore, book value is not an apposite measure in these cases.

What Is Capital Expenditure And Its Formula

The equity portion of a company’s balance sheet contains information about the entire value of its preferred stock. Investments in securities market are subject to market risk, read all the related documents carefully before investing. Determining the PB ratio of the company will not give you a holistic picture of the possible profitability of investing in that company. Calculate other metrics, such as return-on-equity to get more insight into the company’s potential earnings.

It is the value that a company’s shareholders would receive after the company liquidates all its assets and satisfy all its short-term and long-term liabilities. Theoretically, the book value of a company is the difference between the value of its total assets and total liabilities, therefore, it is also called “Net Asset Value” and “Shareholder’s Equity”. The book value doesn’t take into account the value of intangible assets like patents and goodwill; therefore, their value is subtracted while calculating Book Value.

- In a precise manner, book value per share is the amount that the shareholders would receive at the time of liquidation of a company after paying off all its debt and selling its tangible assets.

- P/B ratio shows the relationship between a company’s market capitalisation and its book value.

- If the Price to Book ratio is negative, it indicates that the company is insolvent, which means that the company has higher liabilities than its assets.

- Moreover, it also helps with the pricing of assets bought and the materials used to produce them.

- When the current price of the share of a company is divided by its book value per share, we get the P/B ratio.

Return on equity measures the amount of net income earned in comparison to total shareholder’s equity. A value investor should not get tempted if a stock with a low P/B ratio is identified. When the current price of the share of a company is divided by its book value per share, we get the P/B ratio. P/B ratio acts as a comparison tool while making an investment decision.

Grey Market – Definition, Types, Terminologies & Process

BVPS or book value per share is a company’s value according to its balance sheet. In simpler words, it is the value of an asset after deducting the depreciation calculated over time. Let’s understand the concept of book value better with the help of an example. The table below illustrates a sample balance sheet of XYZ Corporation as of December 2017. The total assets of the company are valued at approximately $45.0 million and the value of all liabilities stood at $35.0 million as of 2017, thus the book value of the company equals $10 million ($45 million – $35 million).

Here, the book value per share is arrived at through the use of a simple formula. Any Grievances related the aforesaid brokerage scheme will not be entertained on exchange platform. Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment. There are other limitations- if the company made any recent write-offs, acquisitions, or share buybacks, then the book value can be distorted. Please ensure you carefully read the risk Disclosure Document as prescribed by SEBI.

Price-to-Book (PB) Ratio: Meaning, Formula, and Example – Investopedia

Price-to-Book (PB) Ratio: Meaning, Formula, and Example.

Posted: Sun, 02 Apr 2017 12:40:49 GMT [source]

It is a healthy practice to derive Year-on-Year Book Value figures for comparing the growth in value of business. Book Value per share is calculated using historical costs, and unlike market value per share, it does not reflect the actual market value of the company’s share. Looking into the book value will also tell you about the company’s internal issues. If a company has faulty assets, then a significant part of earnings might get diluted in repairing and maintaining such assets. Investment experts and renowned investors can speed up the process, but individual investors have nothing but themselves, and an individual alone cannot influence the whole market. Hence, you can find the philosopher’s stone, but it might be of no use to you at the end of the day.

Access Our ‘Low Risk, High Return Potential’Stock ResearchNow 50% Off

For firms with few tangible assets, the book value is less relevant. For example, companies that consists solely of employees, computers, and office space, don’t have a meaningful book value. First, investors will pay a premium above the book value if the company is expected to generate enough earnings in the future. Common stocks from its shareholders, the company can increase the book value per share from Rs. 8 to Rs. 10.

How To Build A Complete Benjamin Graham Portfolio – Seeking Alpha

How To Build A Complete Benjamin Graham Portfolio.

Posted: Thu, 29 Nov 2012 08:00:00 GMT [source]

The information contained on the Website may have been obtained from public sources believed to be reliable and numerous factors may affect the information provided, which may or may not have been taken into account. The information provided may therefore vary from information obtained from other sources or other market participants. Any reference to past performance in the information should not be taken as an indication of future performance. The information is dependent on various assumptions, individual preferences and other factors and thus, results or analyses cannot be construed to be entirely accurate and may not be suitable for all categories of users. Hence, they should not be solely relied on when making investment decisions.

The said additional terms and conditions, if prescribed, would be specific to the corresponding Promotional Offer only and shall prevail over these Terms of Use, to the extent they may be in conflict with these Terms of Use. The Website reserves the right to withdraw, discontinue, modify, extend and suspend the Promotional Offer and the terms governing it, at its sole discretion. This Website is provided to you on an “as is” and “where-is” basis, without any warranty. This is because the figures in the books of accounts are not constantly adjusted for current changes in the market. The book value figure does not reflect factors like changes in share price due to market sentiment, laws of demand and supply, market trends, etc.

In the stock market, book value per share is a benchmark that investors can use to analyse how a company’s stock is valued. For instance, if a company’s book value per share is higher than its market value per share, it is considered undervalued. Similarly, if the book value per share is lower than the market price per share for a company, it is considered overvalued. If both the variables of the ratios are from the balance sheet, then it is classified as the balance sheet ratios. For example, the ratio of current assets to current liabilities is termed the current ratio.

This metric is more useful for bvps formula-intensive companies, that require a high amount of assets. If the Price to Book ratio is negative, it indicates that the company is insolvent, which means that the company has higher liabilities than its assets. This means the company is in huge debt and has insufficient funds to pay back its debts.

The market might believe that the asset value of the company is overvalued. The company might be reporting a consistent loss which is eroding shareholders’ wealth and confidence. Trading in “Options” based on recommendations from unauthorised / unregistered investmentadvisors and influencers. Email and mobile number is mandatory and you must provide the same to your broker for updation in Exchange records. You must immediately take up the matter with Stock Broker/Exchange if you are not receiving the messages from Exchange/Depositories regularly. If you are subscribing to an IPO, there is no need to issue a cheque.

Book value vs. market value

We can conclude that buying 40,000 shares increases Book Value per share from INR 10 to INR 12.5. Book value per share helps calculate the organisation’s net asset value per share. The book value per share of INR 100 means that if Wafira Ltd. is liquidated today, it will leave a profit of INR 100 per share.

You may choose not to create One ID in which case you will not be able to display all your products across ABC Companies on one page. Let us quote an example to understand the workings of book value per share clearly. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month. Pay 20% upfront margin of the transaction value to trade in cash market segment. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020.

Every investor would like to make his/her money work for his/her benefit. To generate wealth for one’s future needs while looking after present financial needs, one must invest in avenues that have a higher growth potential. However, while investing in equity markets, an investor has to exercise a lot of discipline and engage in thorough research before making any investment decision. One of the aspects of detailed research is knowing the book value of a company. Moreover, book value per share or BVPS at any point of time elucidates the shareholders concerning the book value of share they are holding regardless of its market price. Based on that, they can gauge whether stock prices will go down or up in the future.

You authorize us to use/disseminate the information to provide the Financial Solutions however it is not necessarily for you to act on it. It only serves an indicative use of information which you may execute in the manner agreed by you. To help you for your money needs you can avail the facility of MoneyForLife Planner (‘MoneyForLife Planner/ Planner’). MoneyForLife Planner facility is powered by Aditya Birla Money Limited, a subsidiary of ABCL. The Planner provides an indicative view about the generic investment opportunities available in the manner indicated by you.

A stock is considered undervalued if the book value per share is more than the price at which it trades in the market. The total common stockholders’ equity less the preferred stock, divided by the number of common shares of the company. The return on equity is an indicator of the company’s ability to generate returns on the investment made by its shareholders. Return on capital reflects the company’s ability to use its capital efficiently and profitably. If the BVPS is higher than the market value per share, the company’s stock may be undervalued.

- We are certified stock broker review & comparison website working with multiple partners.

- The book value of asset tries to match the book value of shares to the actual assets.

- No Information at this Website shall constitute an invitation to invest in ABCL or any ABC Companies.

- You may look for the numbers required to determine the book value of a firm or asset in its income statement.

- The calcualtion of the ration also indeicate the book value per-share of the company’s net value of assets.

You acknowledge that the Website does not pre-screen content, but that the Website will have the right in their sole discretion to refuse, edit, move or remove any content that is available via the facilities. You agree not to use the facilities for illegal purposes or for the transmission of material that is unlawful, harassing, libelous , invasive of another’s privacy, abusive, threatening, or obscene, or that infringes the rights of others. The Website reserves the right to discontinue or suspend, temporarily or permanently, the facilities.

A Primer On Brookfield Asset Management (NYSE:BAM) – Seeking Alpha

A Primer On Brookfield Asset Management (NYSE:BAM).

Posted: Mon, 09 Jul 2018 07:00:00 GMT [source]

One way to increase the book value per share is to repurchase or buy back common stocks from shareholders. Book value per share is also an excellent metric for investors to forecast the future price. A ratio of two variables from the profit and loss statements is termed the statement of profit and loss ratio. For example, the ratio of gross profit to revenue generated from business operations is referred to as the gross profit ratio. It is calculated using both the figures derived from the profit and loss statement.