Content

Beginning inventory is not part of the calculation because they were the first items in and weren’t sold. Should be supported by more accurate inventory calculations for accounting and tax purposes. Closely reflects the real cost of replacing current inventory; matches the most recent costs to the most recent revenue. Can result in higher reported profit during times when costs are rising.

Generally Accepted Accounting Principles, it is not allowed under International Financial Reporting Standards . In other words, it can be used in the U.S. https://quick-bookkeeping.net/freelance-invoice-template/ but not in many other countries. The specific identification method of inventory control is useful for businesses with unique or high-priced products.

Example of Specific Identification Method in Accounting

Faster inventory forecasting translates to shorter lead times, which goes a long way in boosting customer satisfaction, as well. That’s why the value of the inventory is so integral to the health and wealth of your store—it not only guides your goal setting, but it ensures you’re on track to hit those targets, as well. Keep reading to learn more about the ins and outs of inventory value—and to discover how to calculate this essential value all on your own. Our experts share their invaluable point of view on a variety of timely topics to help you achieve greater efficiencies in your omnichannel fulfillment operations.

- Learn more, including how to calculate beginning inventory and how to use it to ensure uninterrupted fulfillment operations.

- Many companies use the first in, first out or weighted average cost methods for accuracy and simplicity.

- For instance, individual inventory items might be tracked by unique serial numbers, addresses , or title numbers.

- The specific identification method ensures each item is tracked individually, which is perfect for businesses dealing with heterogeneous goods.

- Indirect costs such as selling and warehouse expenses are not included in the cost of inventory due to the difficulty in reasonably allocating them to particular items.

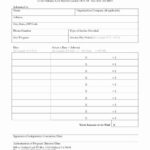

Conceptually, the method matches the cost to the physical flow of the inventory and eliminates the emphasis on the timing of the cost determination. Therefore, periodic and perpetual inventory procedures produce the same results for the specific identification method. The company computes the ending inventory as shown in ; it subtracts the USD 181 ending inventory cost from the USD 690 cost of goods available for sale to obtain the USD 509 cost of goods sold. Assume that the company in can identify the 20 units on hand at year-end as 10 units from the August 12 purchase and 10 units from the December 21 purchase.

Specific identification is a method of finding out ending inventory cost that requires a detailed physical count.

Beginning merchandise inventory had a balance of $3,150 before adjustment. The inventory at period end should be $8,955, requiring an entry to increase merchandise inventory by $5,895. Cost of goods sold was calculated to be $7,200, which should be recorded as an expense. The cost of goods sold, inventory, and gross margin shown in were determined from the previously-stated data, particular to FIFO costing. Merchandise inventory, before adjustment, had a balance of $3,150, which was the beginning inventory.

What is specific identification in periodic inventory system?

The specific identification method is a way to calculate cost of goods sold and ending inventory by tracking every single unit of inventory and adjusting the balances when inventory is sold and when it is purchased.

As additional inventory is purchased during the period, the cost of those goods is added to the merchandise inventory account. Normally, no significant adjustments are needed at the end of the period since the inventory balance is maintained to continually parallel actual counts. It is an issue that smaller businesses don’t generally face, which is why such companies are the ones that commonly utilize the specific identification method. The chances of losing or misplacing inventory under such a system are almost obliterated because of its accuracy. The specific identification method is useful and usable when a company is able to identify, mark, and track each item or unit in its inventory. Ending InventoryThe ending inventory formula computes the total value of finished products remaining in stock at the end of an accounting period for sale.

Understanding the Specific Identification Method

LIFO accounting means inventory acquired at last would be used up or sold first. LIFO InventoryLIFO is one accounting method for inventory How To Calculate Ending Inventory Under Specific Identification valuation on the balance sheet. Sometimes, directly attributable costs like shipping fees are quoted as a single price.

- Consignment inventory arrangements offer benefits for both suppliers and retailers.

- It’s less useful when the company sells many different products with widely differing prices and costs.

- Compute the ending inventory for Dino Radja Company for 2015 using the dollar-value LIFO method.

- However, costs such as freight charges and insurance are usually small, and the cost of trying to allocate them to individual items outweighs the benefit.

- Of cost allocation assumes that the earliest units purchased are also the first units sold.

Generally speaking, FIFO works great for ecommerce brands who are struggling to hit their KPIs despite being an established business. Conversely, the FIFO method likely won’t work as well if your business is just starting out and/or you don’t have much in your inventory quite yet. Once you know what your inventory is worth, you can decide whether you want to stay with your same manufacturers or suppliers, and whether you might need to increase or decrease your warehouse space. In addition, you can better determine pricing structures and how much you’re willing to spend on production . Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.